For the past five months, MerchantE has been publishing blog posts covering a wide range of topics, such as:

In our most recent posts, we explored the concept of moving money out of your business in a two-part blog series. Part one addressed ways to manage your cash flow starting with payroll, and part two discussed stronger expense management.

In today’s post, we’ll explore the fundamentals that drive MerchantE’s Money OUT™ concept—including the features that help you manage how you pay your people and how you manage your expenses.

The Power of Our Platform

First, let’s take a quick look at the engine that powers our Money IN™ / Money OUT™ / Money MAX™ services. The MerchantE financial technology platform begins with payment processing, and ours is one of the few true end-to-end platforms with direct connections to the card associations, like Visa and Mastercard. We built it, we own it, we run it. That means our customers only have one call to make if they ever need help or have questions. Plus, MerchantE is a Level 1 PCI-validated service provider, and we undergo a SSAE-18 SOC assessment annually. We’re serious about our platform, and that mindset lends itself to creating a product suite that fully enhances our core processing heritage.

The Convenience of Our Platform

Our new Money IN™ / Money OUT™ / Money MAX™ suite of products and services elevates our processing platform even more! At MerchantE, we’ve made it our mission to give our customers a competitive advantage and revolutionize the way they bring money in, move money out, and make money decisions.

When we began our transformation journey over a year ago, we really explored the idea of becoming more than a nameless payment processor for our customers. We wanted to become a merchant advocate and business partner that our customers know by name. A big part of that transformation is the suite of products and services powered by our processing platform. And while our Money IN™ solutions diversify how you bring money in, we added the concept of Money OUT™ to strengthen your position in the market.

What is Money OUT™?

Put simply, our Money OUT™ services give you the power of choice when it comes to how and when you pay people—whether it’s your employees, gig workers, or vendors.

But wait—can B2B businesses use these features too? The answer is yes! Consider a few statistics published last year by the Association of Financial Professionals:

- B2B check payments have fallen by nearly 50 percent since 2004.

- Check usage has steadily declined since 2013 and 2016.

- Checks continue to dominate B2B transactions.

According to that same study, “although new technology is appealing, treasury and finance professionals tend to stick with what works for them and their vendors.”

A Better Way for B2B Payments

There’s a perception that if you’re going to change to electronic payments, it will be a huge burden. And according to a PYMNTS article, What It Will Take to Really Kill the Check, the transition for B2B businesses can be a burden “if a firm makes the wrong choices.”

MerchantE has developed products and services to mitigate the pain point of eliminating paper checks. Even more, we’ve streamlined the way you pay your employees and gig workers, as well as revamping the whole idea of your payouts ecosystem, like expense reports, petty cash, and even payroll.

For a deeper dive into our solutions, be sure to check out our two-part blog series about managing payroll expenses and employee expense management.

Our Platform: All for One and One for All

Whether your business is small, medium, or large, our end-to-end platform is designed to work for you. We get it—the thought of changing the way you manage expenses can be daunting, but we’ve made it easy to modernize your payouts ecosystem.

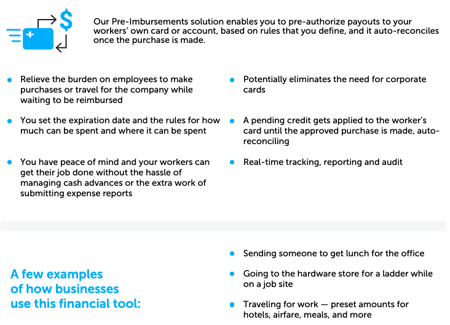

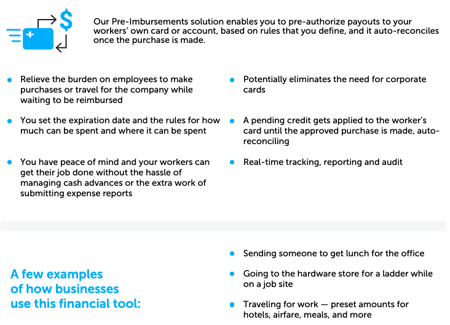

Just imagine the talent you can retain when you offer your employees and gig workers instant pay direct to their bank account. Plus, you don’t even need to change your payroll provider. You can eliminate petty cash and/or burdensome expense reports with our Pre-Imbursements℠. Our Money OUT™ services put you in the driver’s seat when it comes to managing expenses, which is a critical part of running a successful business.

Ready to get started? Learn more about our Money OUT™ services in our interactive guide. Moving money out, simplified. We’re always working to give you the power of choice as you grow your business.